Guarantee Business

Overview of Guarantee Business

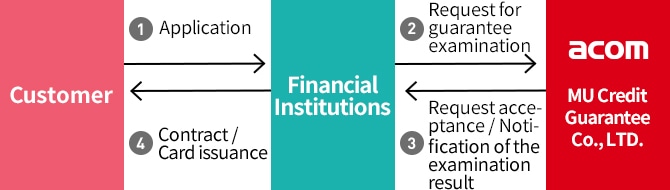

In guarantee business, ACOM provide credit guarantees to customers using loan products provided by financial institutions in alliance. Two companies within the ACOM Group – ACOM and its consolidated subsidiary MU Credit Guarantee Co., LTD. – conduct guarantee business.

ACOM commenced the first guarantee alliance with The Hokkaido Bank, Ltd. based on its sophisticated expertise on credit screening and debt collection it has garnered in loan business ACOM has broadened its alliance network mainly with The MUFG Bank, Ltd. and top-tier regional banks.

Expanding Alliance Network. Guarantee Business Growing with Financial Institutions

ACOM accepts guarantee business of personal unsecured loans entrusted from The MUFG Bank, Ltd., top-tier regional banks, and distribution/online banks in alliance. Not only do we expand alliance network through search for new alliance partners, but also do we offer custom-made guarantee schemes that meet each existing partner's differing needs by providing diverse scope of assistance ranging sales promotion to credit management.

ACOM also provide thorough support on infrastructure and personnel such as provision of screening system based on knowhow from loan business and dispatch of expert staffs.

We will further continue our assiduous challenge to expand business scale as the core company in charge of guaranteeing unsecured card loans within the MUFG Group.

Scheme of Guarantee Business

MU Credit Guarantee Co., LTD.

MU Credit Guarantee Co., LTD. (“MUCG”) is a guarantee company established by ACOM and The Bank of Tokyo-Mitsubishi UFJ, Ltd. (present, "The MUFG Bank, Ltd.") in a joint manner, to succeed guarantee business for financial institutions previously owned by Mobit Co., Ltd. It commenced operation in March 2014 and became ACOM’s wholly-owned subsidiary in December 2015.

MUCG conducts guarantee screening business of personal unsecured loans entrusted to it. In addition, it accepts applications for unsecured loans provided by some alliance partners with its own contact center. It is establishing close partnerships by meeting diverse needs of banks in alliance.