Loan and Credit Card Business

Overview of Loan and Credit Card Business

In March 1960, ACOM's predecessor Maruito Co., Ltd. made entry into "Salary-Man Loan," a type of personal consumer finance business where loans are provided based on personal credit.

In loan business, we mainly provide unsecured loans in small amounts to individuals based on security of customers' “credits.”

ACOM obtained an issuing license of Mastercard® in July 1998 and achieved full-scale advancement into the credit card business. By utilizing "instant credit card issuing machines" located nationwide and the virtual card function, credit cards can be issued on the same day at the earliest, providing added value that other companies do not have.

Characteristics of loan and credit card business can be represented by following 5S's: 1. Speediness; 2. Simplicity; 3. Secrecy; 4. Safety; and 5. Self-service. ACOM has firmly established a business model securing these "5S's" as the leading company in consumer finance industry. In addition, ACOM has always been the front-runner as new service developer and garnered customers’ support.

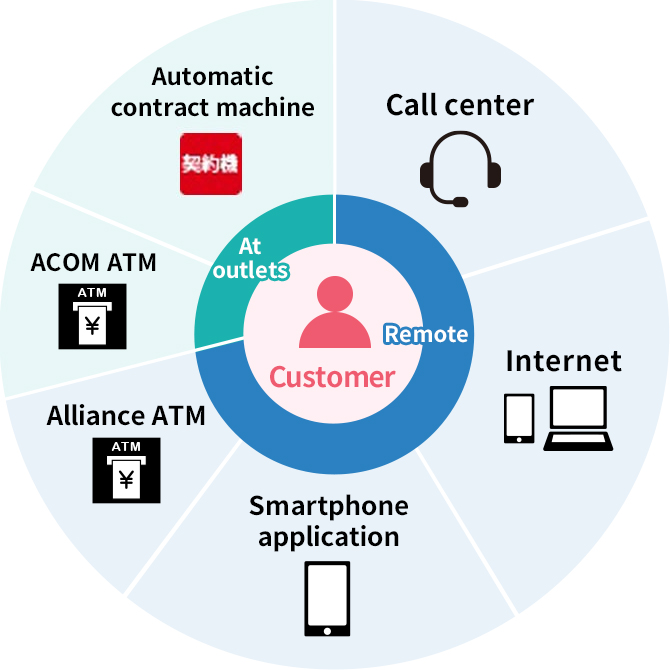

A Customer-oriented sales structure which meets needs through diverse channels

Placing ultimate priority on meeting diverse customers' needs, in addition to the network of consumer finance outlets offered through automatic contract machines, ACOM provides not only our own ATMs, but also deposit and withdrawal channels in alliance with convenience stores and financial institutions, with the concept of easy-to-provide/ easy to repay financing. We also aim for number one customer satisfaction through developing multifaceted sales channels, including a call center, and internet services provided through the PC and smartphones.

Nationwide consumer financing outlets, which is aiming for "No.1" in the region

ACOM has roughly 750 consumer finance outlets. We have secured these in convenient places located in front of stations, and have established road-side outlets which serve automobile users.

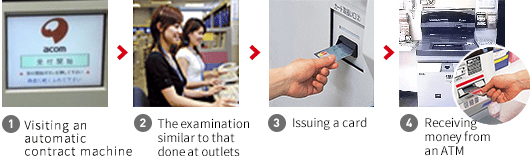

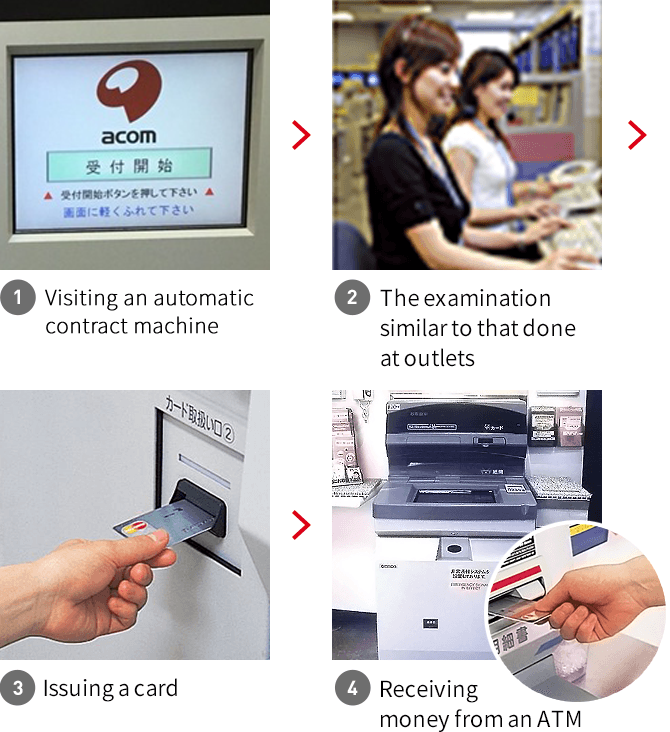

Automatic contract machines produced by ACOM

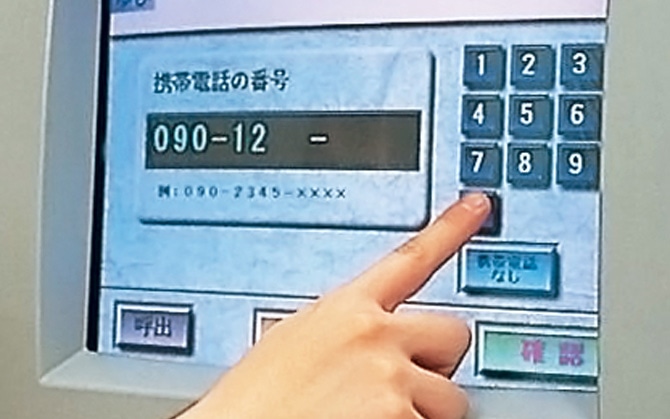

Automatic contract machines, which have acquired strong market support since their introduction in July 1993, are currently operating at roughly 750 locations nationwide. The Automatic contract machine system conducts an examination same to that done at the staffed outlets, through machine's monitor.

This system, controlled centrally at the "Service center", conducts an examination or services similar to those of the staffed outlets, through an IT-driven remote control.

Realizing Staffed Outlet Services on the Internet

The ACOM website provides the same services as staffed outlets. For instance, the service conducting the prior examination of a first-time customer on the internet and providing financing depending on their needs. The navigation has been enhanced, based on our concept of "You can quickly find the information you want, and can achieve your purpose in the shortest time", to provide information services in the IT era. This is also accessible from smartphones, and mobile phones.

The ACOM official smartphone application "myac" enables easy login by biometrics authentication and quick confirmation of account status to existing customers. In addition, new customers are now capable to easily complete all contract procedures on smartphone.

With the application, you can:

- Login easily by biometrics authentication

- Check your account status at a glance (Visual display using graphs)

- Choose to receive our reminder notice

- Make repayment without using cards

- Submit documents for contract and other procedures

- Complete identity confirmation on smartphone

The ATM Alliance Nationwide Expansion

In addition to an infrastructure built in-house, we are focusing on an alliance of ATMs with city banks, regional banks, and convenience stores to increase convenience for customers. The ATM network is covered throughout Japan, and has been increasingly bringing customers closer to ACOM.

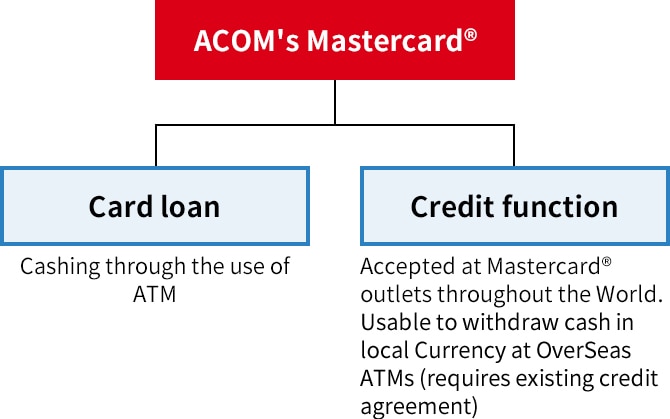

Credit Card Business

ACOM's Mastercard® has been developed as the most user-friendly credit card with comprehensive merits. In addition to being able to issue credit cards in the shortest possible time, our credit cards offer value-added features not available from other companies, such as the ability to choose payment methods and payment amounts at the customer's convenience at the time of repayment.

Merits of ACOM's Mastercard®

- Immediate issuance (except for some outlets)

- Global card usable worldwide

- Free enrollment/annual fee

- Cashing is available 365 days/24 hours

- "Non-installment" or "Revolving"can be selected at the time of repayment

- Repayment can be done at ATM freely

- Due date is up to 82 days

Providing a "voice with a smile" to Each and Every Customer

ACOM has built a sales structure which centrally controls back-office tasks other than face-to-face services, such as responding to or giving guidance on the phone, at the "call center". Our customer services are strengthened through carefully-tuned responses. At our call center, which provides various tasks, including receiving applications and customer inquiries through the phone or internet, communicators respond appropriately to each and every customer's needs. Our high response skill, that puts emphasis on having a "smile", is also highly appreciated by outside specialized institutions.

Advanced Credit Examination Know-how, Supports Immediacy and Planned Use

ACOM has established and utilized advanced credit examination know-how, on the basis of a credit/ examination model - in which the data accumulated to date through customer transaction is analyzed. This credit examination know-how has been deployed through various channels, including outlet examination, "MUJINKUN", automatic contract machine, and internet application, has achieved swift financing, and has been supporting customers' planned use and repayment.