Medium-term Management Plan

Under the vision of “Meeting the expectations of all stakeholders," ACOM Group will focus on priority issues to expand its three core business areas of loan and credit card business, credit guarantee business, and overseas financial business in its medium-term management plan starting in the fiscal year ending March 31, 2023, while working to enhance corporate value.

Medium-term Management Plan (2023/3 - 2025/3)

Medium-term Policy

Capital Policy

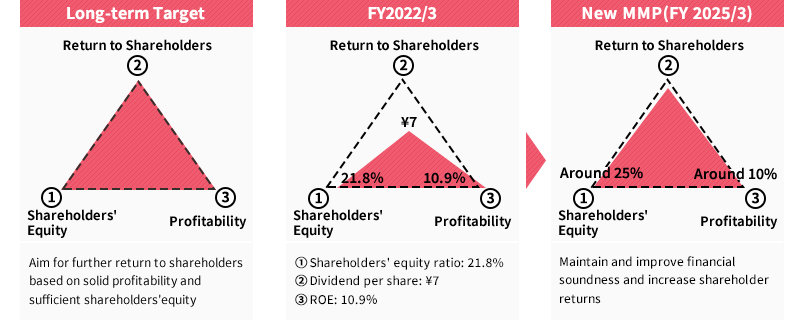

Basic Capital Policy

- The Company aims to further enhance return to shareholders based on solid profit and optimum shareholders’ equity in order to increase corporate value under its medium-term target.

- With this goal in mind, the Company will strive to enhance profitability and return to shareholders while maintaining and improving financial soundness.

Management Indices

-

- Consolidated ROE:

- Around 10%

-

- Shareholders' equlity ratio, computed using the sum consolidated total assets and guaranteed receivables:

- Around 25%

- The company has set target of consolidated around 10%, taking target shareholders’ equity ratio, ROAs of three core businesses and shareholders’ expectation (capital cost) into comprehensive consideration.

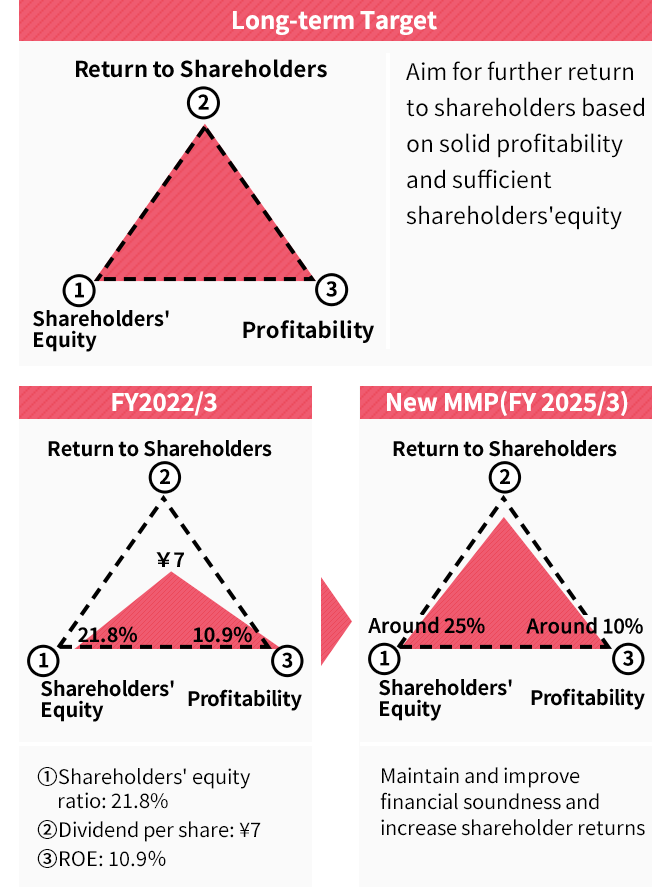

Basic Policy on Dividend Payment

- Aim to increase shareholder returns based on a strong earnings base and adequate shareholders' equity.

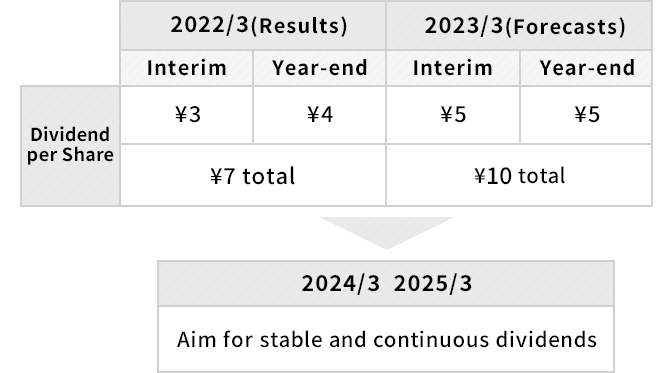

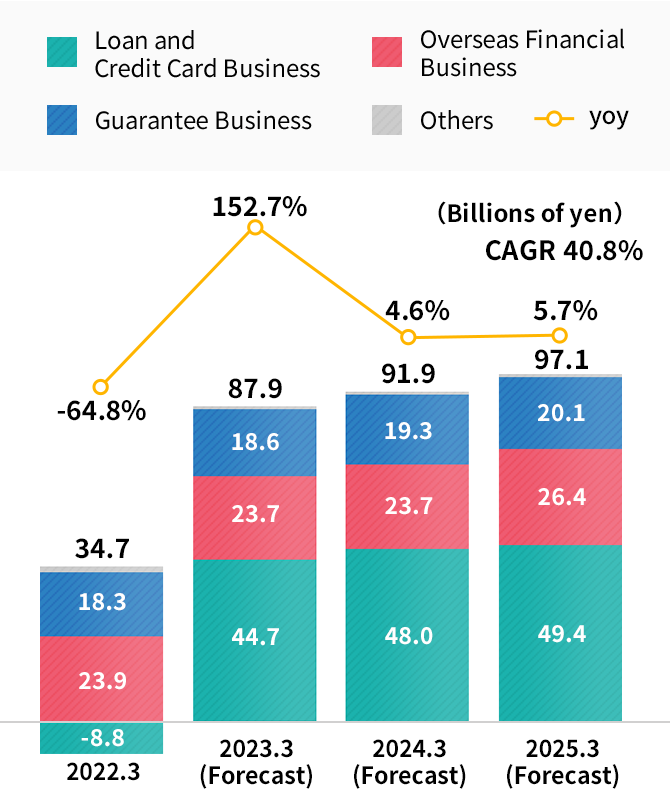

Consolidated Business Scale and Performance Targets

-

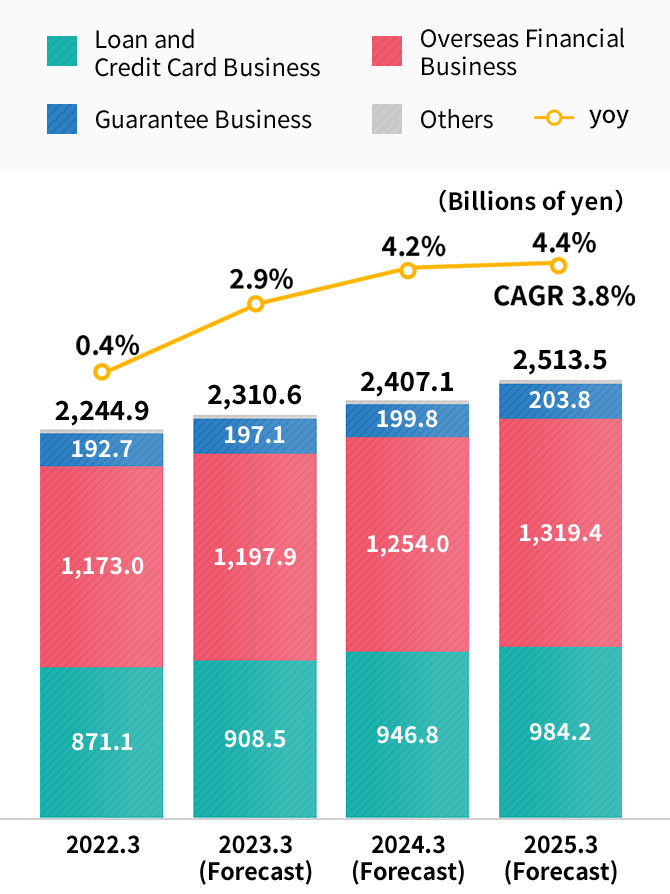

- Loans Receivable

- 2,513.5 billion yen

-

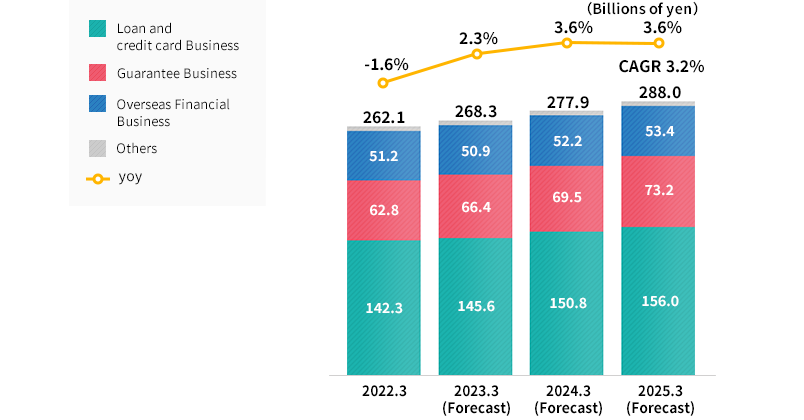

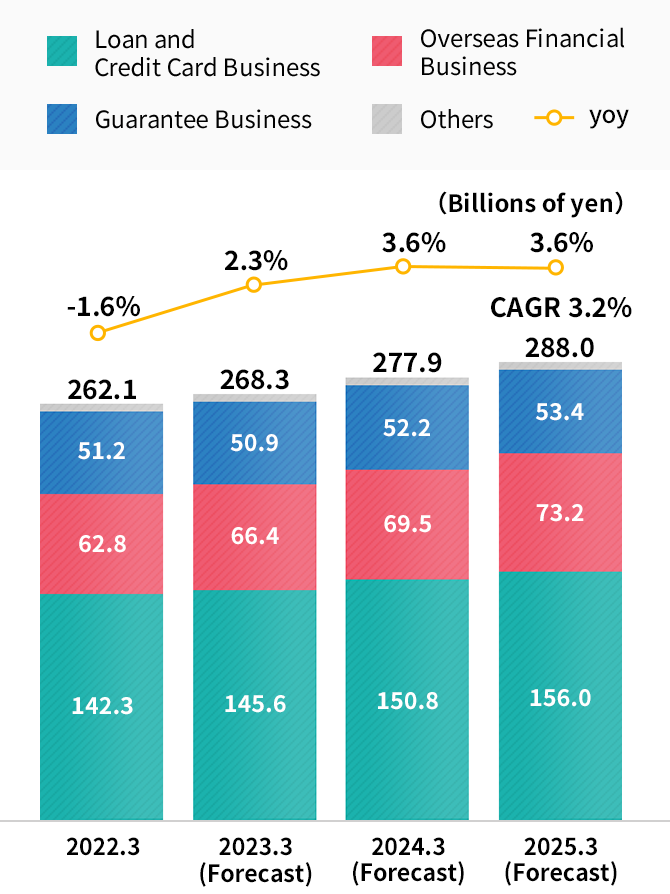

- Operating Revenue

- 288.0 billion yen

-

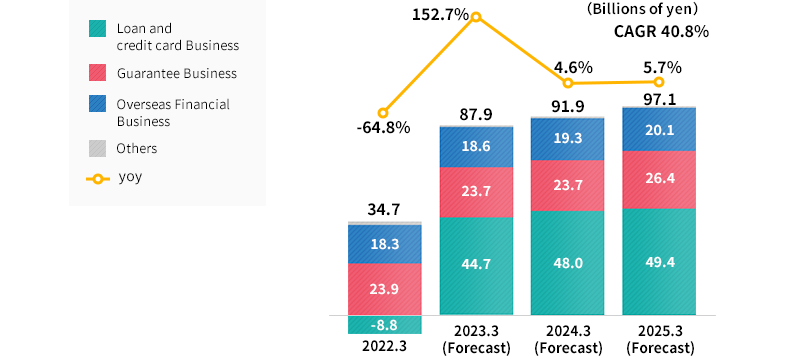

- Operating profit

- 97.1 billion yen

Consolidated Loans Recievable

Consolidated Operating Revenue

Consolidated operating profit

Medium-term Key Themes/Business and Functional Strategies

| Strategies | Themes |

|---|---|

| - |

|

| Business Strategy |

|

| Functional Strategy |

|