As a Member of the MUFG Group

History of Formation of Strategic Business and Capital Alliance with the Mitsubishi UFJ Financial Group, Inc.

Ever since the joint establishment of Tokyo-Mitsubishi Cash One Ltd. with The Bank of Tokyo-Mitsubishi, Ltd. (present, The MUFG Bank, Ltd.) and The Mitsubishi Trust and Banking Corporation (present, The Mitsubishi UFJ Trust and Banking Corporation) in August 2001, ACOM and Mitsubishi Tokyo Financial Group, Inc. (present, Mitsubishi UFJ Financial Group, Inc.) have continued to strengthen cooperative relations. ACOM formed an agreement on strategic business and capital alliance and became an equity-method affiliate of Mitsubishi Tokyo Financial Group, Inc. in March 2004.

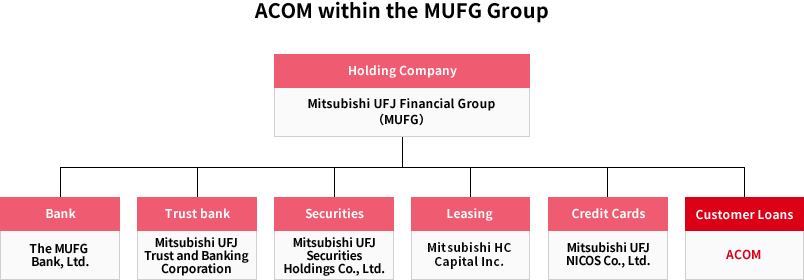

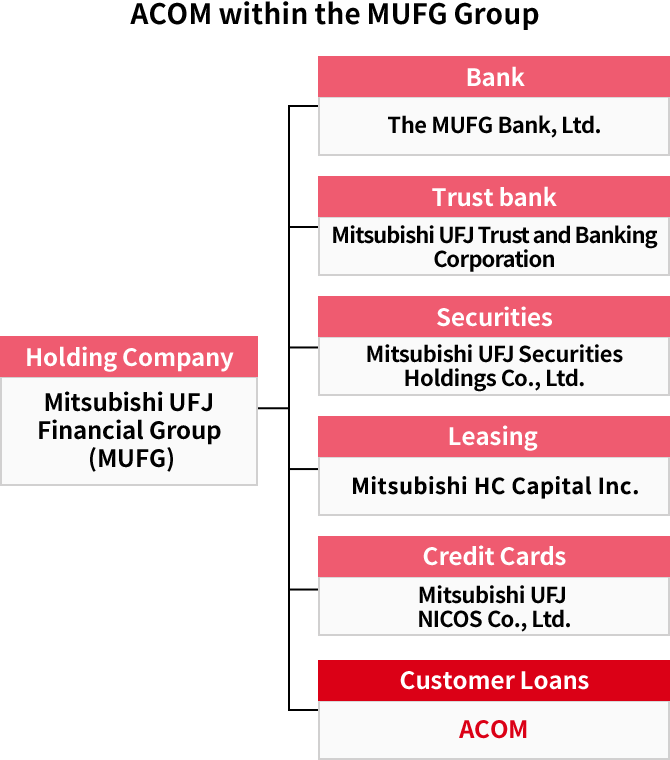

In December 2008, ACOM became a consolidated subsidiary of Mitsubishi UFJ Financial Group, Inc. (MUFG). ACOM is now regarded as the core company in charge of consumer finance business and guarantee business of card loans in MUFG Group.

ACOM will concentrate management resources into loan business, credit card business, guarantee business, overseas financial business and loan servicing business to firmly establish a revenue base for long-term sustainable and stable growth under close cooperation with the MUFG Group.

Announced strategic business and capital alliance with the Mitsubishi Tokyo Financial Group, Inc. (MTFG). On the right is Mr. Shigemitsu Miki, the president of MTFG.

Announced strategic business and capital alliance with the Mitsubishi Tokyo Financial Group, Inc. (MTFG). On the right is Mr. Shigemitsu Miki, the president of MTFG.[March 2004]

Announced further strengthening the alliance with Mitsubishi UFJ Financial Group, Inc. (MUFG). On the right is Mr. Takashi Nagaoka, managing officer and the group head of the Integrated Retail Banking Business Group of MUFG.

Announced further strengthening the alliance with Mitsubishi UFJ Financial Group, Inc. (MUFG). On the right is Mr. Takashi Nagaoka, managing officer and the group head of the Integrated Retail Banking Business Group of MUFG.[September 2009]

Moving Forward to Materialize Consumer Finance Business with Competitive Advantages

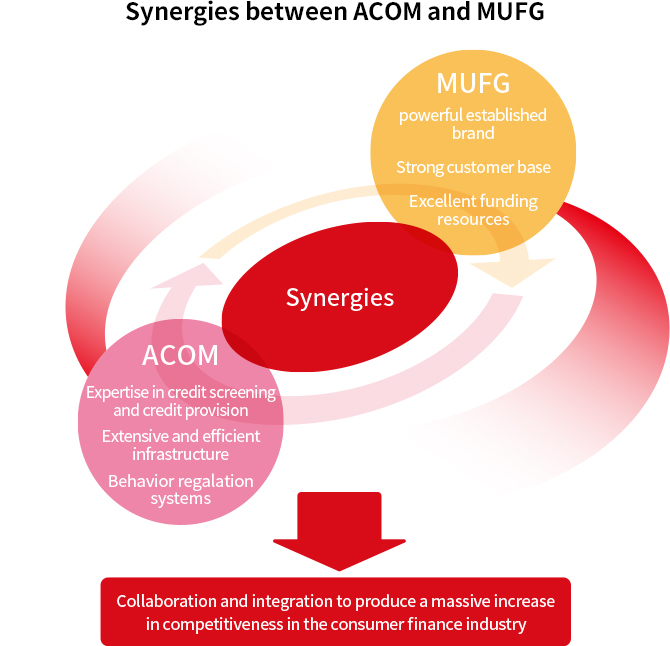

ACOM and MUFG strengthened business and capital alliance in order to "contribute to sound development of domestic consumer finance market through constructing highly competitively advantageous consumer finance business which unites profitability and compliance by enhancing profitability and internal control systems through mutual utilization of each other's expertise and management bases."

ACOM will achieve competitive advantage in consumer finance business by utilizing its expertise in credit screening, mass-scale and effective infrastructure represented by outlet/ATM network and enterprise system, and capability to respond to behavior regulations owing to firm compliance structure. These fortes will be combined with substantial brand power, strong customer acquisition and solid funding resources as the largest domestic comprehensive financial group owned by MUFG.

Synergy Effects Spreading to Other Business Segments

Diverse business segments benefit from synergy effects of becoming a consolidated subsidiary of MUFG.

First, our core loan and credit card business gained competitive advantages in market owing to substantial background, etc. from MUFG brand.

Moreover, guarantee business, which is regarded as the second pillar business at ACOM, enjoys scale expansion as ACOM is in sole charge of guaranteeing unsecured card loans provided by The MUFG Bank, Ltd. while promoting guarantee business with top-tier regional banks in close relation with The MUFG Bank, Ltd.

ACOM also collaborates with The MUFG Bank, Ltd. to develop consumer loan business in Asia domain, actively pursuing overseas financial business.

History of Partnership with Mitsubishi UFJ Financial Group, Inc.

| Month and Year | The Contents of Partnership |

|---|---|

| August 2001 | Established "Tokyo-Mitsubishi Cash One Ltd." with "The Bank of Tokyo-Mitsubishi, Ltd." (present, "The MUFG Bank, Ltd."), "The Mitsubishi Trust and Banking Corporation" (present, "The Mitsubishi UFJ Trust and Banking Corporation"), "DC CARD Co., Ltd." (present, "Mitsubishi UFJ NICOS Co., Ltd."), and "JACCS CO., LTD." |

| March 2004 | Reached an agreement with respect to a strategic business and capital alliance with "Mitsubishi Tokyo Financial Group, Inc." (present, "Mitsubishi UFJ Financial Group, Inc."). |

| April 2004 | Became an equity-method affiliate of "Mitsubishi Tokyo Financial Group, Inc." (present, "Mitsubishi UFJ Financial Group, Inc."). |

| November 2007 | Launched guarantee business of personal card loans offered by "The Bank of Tokyo-Mitsubishi, Ltd."(present, The MUFG Bank, Ltd.) |

| December 2007 | Jointly acquired "PT. Bank Nusantara Parahyangan, Tbk." in Republic of Indonesia with "The Bank of Tokyo-Mitsubishi, Ltd." (present, The MUFG Bank, Ltd.) |

| September 2008 | Agreed upon further strengthening strategic business and capital alliance with "Mitsubishi UFJ Financial Group, Inc." and "The Bank of Tokyo-Mitsubishi UFJ, Ltd."(present, The MUFG Bank, Ltd.) |

| December 2008 | Became a consolidated subsidiary of "Mitsubishi UFJ Financial Group, Inc." as the parent company. |

| September 2013 | Established "MU Credit Guarantee Co., LTD." (present, a consolidated subsidiary) as the business of credit guarantee. |