Corporate Governance

Basic Policies on Corporate Governance

The ACOM Group, guided by its lifelong “circle of trust” spirit, maintains an ongoing corporate commitment to respecting other people, putting the customer first, and conducting creative and innovative management. Based on this commitment, we are seeking to deepen mutual trust between our stakeholders and ourselves and thus progress in partnership with society.

In order to meet the expectations of stakeholders and build stronger trust, we will strengthen corporate governance as a key management priority. To this end, we will take steps to enhance the soundness, transparency, and efficiency of our operations and achieve sustained increases in our shareholder value.

We recognize that effective internal control systems are essential to creating an appropriate corporate governance framework. Based on this recognition, we are encouraging all members of our organization to join forces in building internal control systems and assuring their effectiveness, under the leadership of the management. At the same time, we are constantly evaluating, verifying, and improving the effectiveness of internal control mechanisms already in place.

- Corporate governance report submitted to Tokyo Stock Exchange (Last updated on June 28, 2024) (817KB)

- Basic Policy of Establishing ACOM Group's Internal Control System (Last updated on April 1, 2023) (88KB)

- Basic Policy for the Internal Control over Financial Reporting (Established on December 18, 2007) (74KB)

- Independent Officers Notification (Submitted on June 4, 2024) (98KB)

Reasons for Non-compliance with the Principles of the Corporate Governance Code

- [Supplementary Principle 4.10.1 Independence and Authority Roles of the Appointment Committee and Renumeration Committee]

- ACOM has Appointment and Remuneration Committee in place as optional committee in charge of appointment of and compensation for senior management and directors. The committee deliberates and proposes the appointment candidates and remuneration for Directors to the board of Directors, under the policy of the Appointment and Dismissal of Senior Managements and candidates for management and the Policy of Determination of Compensation to Senior Managements and Directors, in consideration of the advice of independent outside directors. The Appointment and Remuneration committee consists of six members including two independent outside Director. Although Independent outside directors do not constitute the majority of Appointment and Remuneration Committee, the Company ensures their appropriate involvement and receives their suitable advice upon consideration of appointment and remuneration.

Disclosure Based on the Principles of the Corporate Governance Code

- [Principle 1.4 Strategic Shareholdings]

- The Company currently does not have any strategic shareholdings and does not plan to do so in the future.

- [Principle 1.7 Transactions with Related Party]

- Pursuant to relevant laws, it is provided in our regulations of board of directors that transactions with directors and material transactions with major shareholders require prior approval of the board of directors.

- [Supplementary Principle 2.4.1 Ensure Diversity in the Appointment of Core Human Resources]

- <Approach to Ensure Diversity>

Under the situation where competition between companies is intensifying and changes in needs are accelerating, in order to implement “creative and innovative management” that the Company advocates in its corporate philosophy, and to continue to meet the expectations from stakeholders, it is necessary to develop human resources who embody its corporate philosophy by respecting abilities, ideas and values from diverse human resources.

With that in mind, ACOM is actively taking measures to secure diversity, including advancement to manager and human resource development of female and mid-career employees. - <Status of Voluntary and Measurable Goals for Ensuring Diversity>

To ensure the diversity of core human resources, ACOM has set the following targets for the ratio of females and mid-career hires in managerial or higher positions. -

Category As of March 31, 2024 By March 31, 2025

(Target)Percentage of Females in managerial positions (above assistant manager) 21.5% 25.0% Percentage of Mid-Career Hires in managerial positions (above assistant manager)* 6.6% Increase from current level *For the purpose of this tabulation, mid-career hires are defined as “those who joined the company mid-career and have been with the company for 10 years or less.

- < Policies on Human Resource Development, Internal Environmental Development, and Implementation Status to Ensure Diversity>

The Company is aiming to “Contributing to the realization of an enjoyable and affluent personal life, and to improving lifestyle,” based on the stipulations of our corporate philosophy of “The Spirit of Human Dignity,” “Customers First,” and “Creative and Innovative Management,” under our founding spirit of “Circle of Trust.” We promote our business in order to reach our vision of meeting the expectations of all stakeholders. To reach the vision, we believe it essential to maintain sustainable growth for both the company and each employee. We have promoted measures that contribute to enhancing human capital based on our “Policy on Human Resource Development” and “Policy on Internal Environmental Development.”

〔Policy on Human Resource Development〕

Aiming for the Company Group’s sustainable growth, the Company will respect the abilities, ideas, values, etc. of diverse human resources and develop human resources who can embody its corporate philosophy.

〔Policy on Internal Environment Development〕

Based on the Group’s corporate philosophy of “The Spirit of Human Dignity,” the Company will promote diversity and develop an internal environment in which employees can feel motivated and comfortable.

〔Initiatives on Human Resource Development〕

We are implementing measures based on the five points; 1.Recruitment and development of human resources, 2.Workstyle reform, 3.Diversity and inclusion, 4.Evaluation and remuneration of human resource, and 5.Employee engagement. -

Category Status 1. Recruitment and development of human resources The Company is focused on securing human resources who are respecting the abilities, ideas, values, etc. of diverse human resources and embody its corporate philosophy. For that, we believe that striving for overall optimization of human resources as well as improving the quality of human resources are important management issues, and develop relevant measures. In regard to recruitment, we are working to secure excellent and promising human resources through recruitment activities for new graduates and mid-career employees. With regard to training, based on the Policy on Human Resource Development, we are promoting the improvement of the quality of human resources through various development measures and career development support.

Description of specific initiatives related to “Recruitment of promising and excellent human resources.”

- Recruitment activities for new graduates and mid-career hires

In our recruitment activities for new graduates, we hold events such as internships, workplace tours, and roundtable discussions in addition to company information sessions, then we are focusing on securing human resources who can embody our corporate philosophy by conveying our founding spirit and corporate philosophy to as many students as possible.

We also appeal the Company’s job satisfaction and workplace comfort. Our recruitment activities for new graduates were ranked second place in the “Credit, Consumer Credit, Leasing, and Other Finance” category of the “MyNavi/Nikkei 2025 Ranking of Popular Employers for University Graduates.” We will continue to convey the appeal of our company to students to secure promising and excellent human resources.

In our recruitment activities for mid-career employees, we actively recruit human resources with specialized skills to speedily respond to operational issues and seek further expansion in each business domain. We will continue to maximize strength of our organization by securing promising and talented human resources. - Digital human resource development program

In today's rapidly advancing digital world, it is essential to constantly incorporate the latest technology and utilize data to realize our vision.

For the purpose of developing human resources that contribute to digital promotion, the Company started “a digital human resource development program.” In the fiscal year ended March 31, 2024, we selected 50 employees who applied for this program and provided them with basic digital training. In addition, we have supported employees who had joined the program or in positions above Manager to improve digital literacy by providing accounts for video learning services.

From April 2024, we start to provide advanced training (data analysis, programming, AI, UI/UX, etc.) to develop core human resources for digital promotion. - ACOM Leadership Principles (promoting development of leaders)

The leaders of the Company are human resources who can lead our organization to sustainable growth and have the capacity as managers with excellent administrative skills and the ability to support the growth of members. We are committed to developing such outstanding leaders. In April 2023, we formulated the “ACOM Leadership Principles” as the requirements for leaders, and held eight town hall meetings in the fiscal year ended March 31, 2024 based around the theme of these requirements for leaders. - Other support for human resource development and career development

The Company actively works on measures to promote employees’ autonomous career development through means such as various training programs, including selective training and level-based training for the purpose of systematically developing future management candidates, correspondence education, support for acquisition of official qualifications, in-house study meetings, and open recruitment for business school.

2. Work style reform Based on the Policy on Internal Environmental Development and under our corporate philosophy of “The Spirit of Human Dignity,” the Company has created a working environment in which employees can feel motivated and comfortable. We are working on fixed-point observations of engagement and implement measures to maximize the performance of the organization and employees and increase corporate value as a result.

Initiatives related to Work style reform

- Promoted male employees taking childcare leave

The Company has set a target for the rate of male employees taking childcare leave to be 100%. In the fiscal year ended March 31, 2024, President & CEO Masataka Kinoshita send a message to encourage male employees to take childcare leave and featuring personal stories male employees who have taken childcare leave in our company newsletter. - Promotion of Health and Productivity Management

As a result of this endeavor, the Company has been recognized as a Superior Health Management Corporation by the Nippon Kenko Kaigi for the third consecutive year.

For more details on these initiatives, please refer to the Company’s website.

https://www.acom.co.jp/corp/english/csr/theme/staff/ - Implemented Job Challenge

Aiming to realize an environment where diverse human resources can work with vitality, in the fiscal year ended March 31, 2024, we planned an internal recruitment system called “Job Challenge” and some employees moved to four different departments. By encouraging employees to seize growth opportunities through their own volition, we are committed to promoting their autonomous career development.

Aiming to realize an environment where diverse human resources can work with vitality, in the fiscal year ended March 31, 2024, we planned an internal recruitment system called “Job Challenge” and some employees moved to four different departments. By encouraging employees to seize growth opportunities through their own volition, we are committed to promoting their autonomous career development. - Other initiatives related to Work style reform

-

- Introduced a secondary job system, mainly for individual business owner

- Added 7-hour workday system to the shorter work hours system for employees returning to work after childcare leave (previously, only 6-hour workdays were available)

- Introduced allowance to support returning to work for employees who wish to return to work from childcare leave early

- Certified for three consecutive years with the “Superior Company Welfare (General) Award” through “Hataraku Yell” (selected by the Executive Committee of the Welfare Award and Certification System)

- Acquired the Kurumin Mark for the fiscal year ended March 2021

3. Diversity and Inclusion Based on the Policy on Internal Environmental Development and under our corporate philosophy of “The Spirit of Human Dignity,” the Company is working on promoting DEI (diversity, equity, and inclusion) and creating a working environment in which employees can feel motivated and comfortable.

Initiatives related to Diversity and Inclusion

- Participation and advancement of female employees

The Company established the “Woman Career Program” in the fiscal year ended March 2023, a training program to support female employees recognize the need for autonomous career development and their challenges. As of the current point in time, 32 women have participated in this program. Joining this program has led directly to further action, including 10 participants who have applied for selective training that is available for the purpose of developing future management candidates. - Participation of Senior employees

Established new salary system for senior employees with specialized skill based on the expertise in order to promote active participation. - Developed a follow-up system for employees with disabilities

To create a working environment in which employees with disabilities can feel motivated and comfortable, we conducted questionnaires once a year and interviews with their supervisor and Human Resources Department several times a year.

4. Evaluation and remuneration of human resources To create a working environment in which employees can feel motivated and comfortable, we are working to build a system that is more rewarded to employees based on the Policy on Internal Environmental Development.

- Wage Increase

In accordance with the "Principles of Wage Determination," we improve the treatment of the profits and results we generate by raising wages and other measures in an appropriate manner based on our company's situation. We have made large-scale improvements to the treatment of employees (April 2019, October 2022, and April 2024) and lump-sum payments (June 2018, July 2020). In addition, in order to further improve employees' job satisfaction, we have changed the system (July 2022) to allow employees to reflect their achievements more than ever in bonuses.

5. Employee Engagement Based on the Policy on We are working on fixed-point observations of engagement and implement measures to maximize the performance of the organization and employees and increase corporate value as a result.

Initiatives related to Employee Engagement

- Conducted engagement surveys

Since 2019, we have been conducting employee engagement surveys (through Motivation Cloud provided by Link and Motivation Inc.) that measure employee expectations and satisfaction and provides a fixed-point observation of the state of engagement in the organization. In addition, we were ranked in the top 10 in the Large Companies category in the Best Motivation Company Award organized by Link and Motivation for the fifth consecutive year. Based on the results of these survey, we are working to improve engagement for our employees and the organization while maintaining communication between officers, chief general managers, and the Human Resources Department. - Vision Ingraining Program

On developing the medium-term management plan (fiscal year ended March 31, 2023 to fiscal year ended March 31, 2025), the Company reviewed and revised its vision and has made clearer its commitment to each of its stakeholders. In addition, the Company created a Vision Book and distributed it to all employees. Since September 2022, this Vision Book has been used in the Vision Ingraining Program, which designed to provide an opportunity for the officers and employees to discuss the Company’s vision. In the fiscal year ended March 31, 2024, the second year of the program, aiming to instill meaning in business operations and enhance employees’ senses of pride, duty, and ownership, each employee was tasked with drafting a specific action plan for realizing the Company’s vision based on discussions between the officers and employees. - Established the business contest “DRIVE” across the ACOM Group

The Company believes that providing incentives for employees to take on challenges and aiming to be an organization that practices “Creative and Innovative Management” leads to enhancing corporate value. We held a business contest across the ACOM Group (total of 97 proposals) in the fiscal year ended March 31, 2023. In addition to general business proposals, the contest accepted entries related to all types of improvements and functional variations, promoting a structure that provides the opportunity for any employee to look forward toward new challenges.

- Recruitment activities for new graduates and mid-career hires

- [Principle 2.6 Functioning as an Asset Owner for Corporate Pension Plans]

- The Company has Corporate Pension Asset Management Committee in place to effectively manage corporate pension asset. The committee comprises of the director in charge of Human Resources Dept. and chief general managers of Human Resources Dept., Corporate Planning Dept., Finance Dept. and Treasury Dept.

The members of the committee need to deepen their understandings on investment theory, asset management system, contents of asset for investment, etc. They also need to grasp asset management environment. Therefore, the Company provides necessary information from trustee management institutions to committee members in periodic manner.

The committee discusses basic policy on corporate pension asset management, matters on investment and trustee management institutions. The Company further discusses these matters at management meeting where Audit and Supervisory Committee members attend and share their opinion. Therefore, the Company ensures appropriate management of corporate pension asset.

- [Principle 3.1 Enhancement of Information Disclosure]

-

(i) Guiding Principles of the Company (Corporate Philosophy, etc.), Management Strategy and Management Plan

(1) Guiding Principles of the Company (Corporate Philosophy, etc.)

Please refer to “Corporate Philosophy” on our website.

(2) Management Strategy and Management Plan

Please refer to “Medium-term Management Plan” on our website.

-

(ii) Basic approach and key policies on corporate governance

Please refer to “I. 1. Basic Policy” of this report for our basic approach and key policies on corporate governance.

-

(iii) Policies and procedures for determining compensations for senior management and directors

Please refer to “II. 1. [Compensation for Directors]” of this report for our policies and procedures for determining compensation for senior management and directors.

-

(iv) Policies and procedures for appointing and dismissing senior management, and nominating candidates for directors

(1) Policies

(A) Appointing Senior Management

- The candidate owns rich experience, in-depth insight and high expertise of Company’s business which are necessary for conducting swift and pertinent business execution.

- The candidate possesses great humanity such as wide trust from others, dignity and high moral.

- The candidate is sound both in mind and body, and does not possess possible concern for business performance.

- The candidate does not have any past record of violations of law and compliance (including harassment) which inflicted significant loss to the Company and any other entities the candidate has served.

- The candidate is not affiliated with any anti-social forces.

(B) Dismissing Senior Management

- A senior management is dismissed when one no longer meets criterions under appointment policy.

(C) Nominating Candidates for Directors (Excluding Those Serving as Members of Audit and Supervisory Committee)

- The candidate owns rich experience, in-depth insight and high expertise which are necessary for efficient supervision on management.

- The candidate possesses great humanity such as wide trust from others, dignity and high moral.

- The candidate is sound both in mind and body, and does not possess possible concern for business performance.

- The candidate does not have any past record of violations of law and compliance (including harassment) which inflicted significant loss to the Company and any other entities the candidate has served.

- The candidate is not affiliated with any anti-social forces.

(D) Nominating Candidates for Directors Serving as Members of Audit and Supervisory Committee

- The candidate owns rich experience in management, laws, finance and accounting, combined with deep insight and high degree of expertise needed for achieving management transparency and improving objectivity.

- The candidate possesses great humanity such as wide trust from others, dignity and high moral.

- The candidate is sound both in mind and body, and does not possess possible concern for business performance.

- The candidate does not have any past record of violations of law and compliance (including harassment) which inflicted significant loss to the Company and any other entities the candidate has served.

- The candidate is not affiliated with any anti-social forces.

(E) Nominating Candidates for Directors Appointed as Independent Directors

- The candidate within (C) and (D) who is appointed as Independent Directors meets all requirements below and items set forth in “Independence Standards for Outside Directors.”

* Please refer to “I. 1. Basic Policy [Disclosure Based on the Principles of the Corporate Governance Code] [Principle 4.9]” for “Independence Standards for Outside Directors.” - The candidate is capable of offering advices on management policies and management improvements, by utilizing knowledge, from the viewpoint of increasing medium- to long-term corporate value by promoting sustainable growth of the Company.

- The candidate is capable of supervising management through appointment/dismissal of senior management and other significant decision makings at the Board of Directors.

- The candidate is capable of supervising conflict of interests between the Company, management, controlling shareholders, etc.

- The candidate is capable of reflecting opinions of stakeholders including minority shareholders at the Board of Directors, independent from the management and controlling shareholders, in a proper manner.

-

(2) Procedures

(A) Appointing and Dismissing Senior Management

The board of directors resolves appointments based on policies above after examinations are conducted and proposals are made by appointment and remuneration committee.

-

(B) Nominating Candidates for Directors (Excluding Those Serving as Members of Audit and Supervisory Committee)

The board of directors resolves appointments based on policies above after examinations are conducted and proposals are made by appointment and remuneration committee.

-

(C) Nominating Candidates for Directors Serving as Members of Audit and Supervisory Committee

The board of directors resolves appointments based on policies above upon agreement by the Audit and Supervisory Committee after examinations are conducted and proposals are made by president.

-

(v) Explanation on Appointment of Senior Management and Nomination of Individual Candidates for Directors

Explanation on appointment of senior management and nomination of individual candidates for directors (excluding those serving as members of Audit and Supervisory Committee) and directors serving as members of Audit and Supervisory Committee is mentioned on our convocation notice for ordinary general meeting of shareholders which is available for inspection on our website.

General Meeting of Shareholders

- [Supplementary Principle 3.1.3 Disclosure of initiatives related to Sustainability, etc.]

-

ACOM has adopted the "Basic Policy on Sustainability", aiming to reconcile solutions to social issues with enhancing corporate value.

Sustainability

In addition, ACOM has established the Sustainability Promotion Office under the Finance Department to examine and formulate companywide sustainability plans. Key matters are deliberated and decided at the Executive Officers’ Meeting and Board of Directors meeting, and through this, we are working to develop the Company’s sustainability promotion organization. Please refer to our "Basic Policy on Sustainability" and our sustainability-related initiatives in the "Sustainability" section of our website.In addition, the Company has implemented the following initiatives related to investment in human capital and intellectual property.

Category Details Investment in Human Capital ACOM has set up a Personnel Development Office, which is a specialized department for employee education, and implemented various training programs such as “on-the-job training (OJT),” “level-based training,” “selective training courses” and “digital human resource development program”. ACOM also has implemented self-development support such as “correspondence education”, “public qualification acquisition support”, “reading support”, and promotion of acquisition of “Chief of money lending operation” qualification. Investment in Intellectual Property ACOM has implemented brand awareness activities to strengthen its brand power, AI-based data analysis to enhance credit and credit screening capabilities, and employee training and CS promotion activities to enhance customer service.

- [Supplementary Principle 4.1.1 Scope of Delegation to Management]

- The Company delegates decision-making on matters related to the execution of business operations other than matters to be resolved at the Board of Directors, to president and director. Moreover, the “Rules for the Board of Directors” of the Company provides the matters to be discussed at the Board based on laws and the article of incorporations. With regard to other business executions, the Board aims for expedite decision-makings and business execution, and clarification of roles of supervision and execution through following measures: appointing directors in office; providing division of duties, and roles and responsibilities on “Rules for Division of Duties within the Company”; and delegating business execution to executive officers.

- [Principle 4.9 Independence Standards and its Qualifications for Independence Outside Directors]

- The Company has set following “Independence Standards for Outside Directors” in order to focus on ensuring independence of Outside Independent Directors.

-

“Independence Standards for Outside Directors”

The Company appoints Independent Outside Directors who meet all requirement items 1 through 7 below.

1. Meet all requirements stipulated under Article 2, Paragraph 15 of the Companies Act;

2. Do not fall under any of items (1) through (3) below.

- (1) Major creditors of the Company1 or their executors of operations, and were executors of operations in the last three years;

- (2) Those for whom the Company is a major business partner2 or their executors of operations, and were executors of operations in the last three years;

- (3) Major business partners of the Company3 or their executors of operations, and were executors of operations in the three years;

3. Are not consultants, accountants or legal experts who receive, in terms of the average for the past three years, \10 million or more of monetary or other property benefits other than executive remunerations from the Company, nor belong to accounting or law firms where the Company is a major business partner4;

4. Are not Directors, officers or executive officers of the Company or its subsidiaries, nor spouses or relatives within the second degree of kinship of those whom the Company judges their independences are not ensured as provided in items 2 and 3;

5. Are not current major shareholders5 of the Company or their executors of operations;

6. Those who do not belong to auditing firms of the Company or its subsidiaries, nor were in charge of auditing operations of the Company or its subsidiaries as employees of said auditing firms;

7. Were not executors of operations at the parent company and/or fellow subsidiary of the Company in the last ten years.

-

- (Notes)

- 1. “Major creditors of the Company” refer to those the Company procures 3% or more of its consolidated amount of borrowings.

- 2. “Those for whom the Company is a major business partner” refer to those the Company accounted for 2% or more of their consolidated sales.

- 3. “Major business partners of the Company” refer to those who accounted for 2% or more of the Company’s consolidated operating revenue.

- 4. “Accounting or law firms where the Company is a major business partner” refers to those the Company for 2% or more of their consolidated sales.

- 5. “Major shareholders” refer to those who hold 10% or more of the Company’s total voting rights.

- * Transaction included in “Attributes of Directors” shall be omitted as within range of negligible standard when items above are fulfilled.

- [Supplementary Principle 4.11.1 The Policy of the Composition of the Board of Directors and the Skill Matrix]

- <The Policy of the Composition of the Board of Directors>

- To ensure that the Board of Directors fulfill its rolls and responsibilities effectively, the Company has established the Policy of the Composition of the Board of Directors as follows.

-

- Balance of knowledge, experience, and abilities

- Based on the management strategy, the Company has defined the skills that the directors should have, as stated below. The Board of Directors must have an appropriate balance of these skills as a whole.

-

Skills Definitions Corporate Management /Management Planning - Meet any of the followings:

- Experiences to be a board of directors of the Company(including subsidiaries) or other companies

- Experiences in planning and implementing of business strategies in the Company(including subsidiaries) or other companies

- Have deep insight in the fields

Business Management - Experiences in Corporate Governance or HR management

- Have deep insight in the fields

Execution of Business - Experiences of the Company’s core businesses: Loan / Credit Card Business, Credit Guarantee Business, and/or Overseas Business

- Have deep insight in the fields

System / Digital - Experience of System and/or Digital of the Company

- Have deep insight in the fields

Finance / Accounting - Meet any of the followings:

- Experience of Finance and/or Accounting and have deep insight in the fields

- High level expertise in Accounting, such as being a CPA

Legal / Compliance /Risk Management - Meet any of the followings:

- Experience of Corporate Laws, Compliance and/or Risk Management, and have deep insight in the fields

- High level expertise in Law, such as being a Lawyer

- Meet any of the followings:

- *In principle, directors who are audit committee members shall include those with sufficient knowledge of finance and accounting, and Independent Outside Director shall include those with management experiences at other companies.

- Diversity

- The composition of the Board of Directors shall take into account diversity in terms of gender, cosmopolitanism, professional experiences and age.

- Size

- The Board of Directors shall be composed of an appropriate number of members, taking into consideration the Company’s Business domain and size, in order to keep a speed of decision-making process or ensure the effectiveness of the mutual supervisory function of the directors.

- Balance of knowledge, experience, and abilities

- The Board of Directors of the Company consists of ten members at the point, three of whom are Independent Outside Directors, in order to expedite decision-makings and ensure effective mutual monitoring among directors. In order to ensure diverse perspectives in the Board, the Company appoints individuals with following qualifications as Directors: rich experience within the Company or from different companies; deep insight and high expertise.

- The Company have created a skill matrix of the Board of Directors as follows:

-

Name Position Age Corporate

Management

and PlanningBusiness

ManagementExecution

of DutiesSystem

and

DigitalFinance and

AccountingLaw,

Compliance,

and, Risk

ManagementDirector

(outside)Shigeyoshi Kinoshita Chairman 75 ● ● ● Hiroshi Naruse Deputy Chairman 65 ● ● ● Masataka Kinoshita President & CEO 46 ● ● ● Takashi Kiribuchi Deputy President 62 ● ● ● Tomomi Uchida Senior Managing Director 62 ● ● ● Tadashi Yamamoto Director 55 ● ● ● Michelle Tan Director 62 ● ● ● Toshihiko Yamashita Director, Member of the Audit and Supervisory Committee 68 ● ● ● ● Akihiro Kiyooka Director, Member of the Audit and Supervisory Committee 56 ● ● ● Takuji Akiyama Director, Member of the Audit and Supervisory Committee 66 ● ●

Certified public accountant● ● -

- * The above is a list of up to three major skills marked that each director possesses. It does not represent all the skills that each director possesses.

- * The age, shown above, is as of the 47th Ordinary General Meeting of Shareholders (June 21, 2024)

- [Supplementary Principle 4.11.2 Concurrent Post of Directors]

- Information on individual directors who have material concurrent post including other listed companies is mentioned on our convocation notice for ordinary general meeting of shareholders which is available for inspection on our website.

- General Meeting of Shareholders

- [Supplementary Principle 4.11.3 Analysis, Evaluation, and Results of the Overall Effectiveness of the Board of Directors]

- The Company distributes surveys regarding the effectiveness of the Board to all directors every year. The Company conducts analysis and evaluation on effectiveness of the Board based on the results of surveys.

The Company conducted abovementioned analysis and evaluation this fiscal year.

Consequently, the Company confirmed that the Board fulfills each and all of its function in formulation of management strategies and targets, settling management challenges, supervision on risk managements and business executors. Thus, the Company concluded that its current Board functions properly and its effectiveness is ensured.

In addition, we appreciate that a certain amount of progress has been made in expanding useful information to deepen and revitalize discussions at the Board of Directors, which was recognized as an issue in the previous year. However, we recognize that it is necessary to continue to enhance the content of reports to strengthen the supervisory function and to enhance discussions to fulfill the functions of the Board of Directors.

The Company recognized that current issues to be addressed include: deepening of discussions at the Board and expansion of useful information for further invigorating discussions at the Board. While the company will operate the Board of Directors in manners as described below, the Company will sustain periodic analysis and evaluation on effectiveness of the Board and continue its efforts to ensure enhanced effectiveness of the Board. - (1) The Board will decide material business management matters, such as management strategies and business plans, and also will determine basic policies for building corporate governance and internal control systems. The Board will monitor and supervise the execution of duties.

- (2) Material subjects will be exhaustively selected as agendas based on regulations for matters to be resolved at the Board, provided in rules of the Board of Directors. The Board will discuss such selected material in timely and appropriate manner.

- (3) The Company will distribute materials to be used at the Board prior to the meeting to make it efficient and vigorous. Prior explanations will be given when deemed necessary.

- (4) The Board will receive periodic reports on business managements, etc. and supervises business execution.

- [Supplementary Principle 4.14.2 Policy on Trainings for Directors]

- The Company provides trainings to directors when deemed necessary upon their inaugurations. Even after their assumption of offices, the Company provides continuous training programs on diverse topics such as market trend of the Company’s business segment and global economic issues

- [Principle 5.1 Policy on Constructive Dialogue with Shareholders]

- (1) Basic Policy on Measures to Promote Constructive Dialogues with Shareholders

- The Company strives for timely and appropriate dialogues with every shareholder to attain continuous growth and mid- to long-term enhancement in corporate value. With regard to information disclosure, in addition to the statutory disclosure and timely disclosure required by laws and regulations, we will actively disclose information that we believe is important or useful for our shareholders to deepen their understanding of our company, and we will strive to disclose information fairly and promptly, giving due consideration not only to shareholders in Japan but also to those overseas, by using methods designated by the Financial Services Agency and the Tokyo Stock Exchange and our website.

Upon disclosing such information, we will strive to disclose information in fair and prompt manner to both the domestic and the overseas shareholders through our website and processes designated by the Tokyo Stock Exchange.

In certain cases, forward-looking statements may be included in the information that we disclose. In regard to such forward-looking statements, we will strive to fully explain our assumptions, uncertain factors, etc. in order to avoid giving a false impression to the market.

In order to prevent divulgence of financial results information and ensure fairness of information disclosure, certain period prior to announcement of financial results shall be regarded as “Silent period” where we refrain from making any comments or answering inquiries regarding financial results. - (2) Development of Systems to Promote Constructive Dialogues with Shareholders

- In addition to the ordinary general meeting of shareholders, the director in charge of Finance Dept. presides over dialogues with shareholders. Public & Investor Relations Office collaborates with relevant departments and conducts interim and annual earnings release conferences, domestic conferences (4 times a year), overseas IR roadshow (twice a year) and individual IR meetings (from 200 to 300 meetings per year).

Feedbacks given through these contacts with shareholders are reported to the Board of Directors.

Corporate Governance and Internal Control System Structure

An overview of corporate governance structure and reasons for employing said structure

The Company is a company with an Audit and Supervisory Committee and aims to enable swift decision-making and enhance the Board of Directors’ supervisory functions by significantly delegating decision-making on material business executions to directors from the Board of Directors. The Board of Directors, in turn, performs thorough monitoring and other measures on delegated matters.

The Company aims to improve the transparency and objectivity of its management by having an Audit and Supervisory Committee composed mainly of outside directors conduct audit and supervisory functions.

The organs installed by the Company are as follows:

Board of Directors

The Board of Directors of the Company consists of nine members: President & CEO Masataka Kinoshita who chairs the Board, Directors Shigeyoshi Kinoshita, Hiroshi Naruse, Takashi Kiribuchi, Tomomi Uchida, Tadashi Yamamoto and Michelle Tan, and Members of Audit and Supervisory Committee Toshihiko Yamashita (Outside Director), Akihiro Kiyooka and Takuji Akiyama (Outside Director).

The Board deliberates and decides important business management matters, such as management strategies and business planning, and basic policies for building corporate governance and internal control systems, while ensuring objective and rational judgment. Furthermore, the Board delegates decision-making on matters related to the execution of business operations other than matters to be resolved at the Board of Directors to President and Director, and monitors and supervises the execution of duties by thorough monitoring and other measures on delegated matters.

It meets at least once every quarter, in principle, and more as deemed necessary.

During the current fiscal year, the Company held a total of 12 Board of Directors meetings. Status of attendance at meetings of each Board of Directors member is as follows:

| Name | Number of meetings held | Number of meetings attended | Number of attendance |

|---|---|---|---|

| Shigeyoshi Kinoshita | 12 | 12 | 100% |

| Hiroshi Naruse | 12 | 12 | 100% |

| Masataka Kinoshita | 12 | 12 | 100% |

| Takashi Kiribuchi | 12 | 12 | 100% |

| Tomomi Uchida | 12 | 12 | 100% |

| Masakazu Osawa*1 | 4 | 4 | 100% |

| Tadashi Yamamoto*2 | 8 | 7 | 87.5% |

| Michelle Tan*3 | - | - | - |

| Masahide Ishikawa*1 | 4 | 4 | 100% |

| Toshihiko Yamashita*2 | 8 | 8 | 100% |

| Kazuo Fukumoto*4 | 12 | 12 | 100% |

| Akihiro Kiyooka*3 | - | - | - |

| Takuji Akiyama | 12 | 12 | 100% |

- (*1) This member has retired from the position of Director as of June 23, 2023. Thus, the status of attendance includes attendance at Board of Directors meetings held during the period prior to their retirement.

- (*2) This member was appointed to the position of Director as of June 23, 2023. Thus, the status of attendance includes attendance at Board of Directors meetings held during the period following their appointment.

- (*3) No data is available as this member assumed the position of Director as of June 21, 2024.

- (*4) This member has retired from the position of Director as of June 21, 2024.

The Board of Directors has determined the following items mainly as details to be deliberated in the current fiscal year.

[Details of management strategy-related matters]

- Items relating to single-year management plans

- Items relating to the revision of full-year performance forecasts

- Items relating to interim and year-end dividends

[Details of business management-related matters]

- Items relating to Basic Policy of Establishing ACOM Group’s Internal Control System

- Items relating to the enhancement of stances on risk management

[Details of financial results and accounting-related matters]

- Items relating to financial statements

- Items relating to business reports

[Corporate management-related items]

- Items relating to the selection of the positions of Representative Directors and Directors

- Items relating to basic compensation, performance-linked compensation and stock price-linked compensation for Directors

Audit and Supervisory Committee

The Audit and Supervisory Committee consists of three members: Toshihiko Yamashita (Outside Director) who chairs the committee, Akihiro Kiyooka and Takuji Akiyama (Outside Director).

It meets regularly to receive reports concerning important audit-related matters, hold discussions, and pass resolutions.

Committees

-

- Appointment and Remuneration Committee

-

The Appointment and Remuneration Committee consists of six members: President & CEO Masataka Kinoshita who chairs the committee, Representative Directors Shigeyoshi Kinoshita and Hiroshi Naruse, and Members of Audit and Supervisory Committee Toshihiko Yamashita (Outside Director), Akihiro Kiyooka and Takuji Akiyama (Outside Director).

The Appointment and Remuneration Committee reviews and proposes the appointment of candidates and remuneration for Directors (excluding those serving as Audit and Supervisory Committee Members) for resolution at the Board of Directors Meeting. The Committee also checks management and the status of training for candidates for management and provides an overview of the same to the Board of Directors.

The Appointment and Remuneration Committee meets three times a year, in principle, and more as deemed necessary.

During the current fiscal year, the Company held a total of 6 Appointment and Remuneration Committee meetings. Status of attendance at meetings of each Appointment and Remuneration Committee member is as follows:

Name Number of meetings held Number of meetings attended Number of attendance Shigeyoshi Kinoshita 6 6 100% Hiroshi Naruse 6 6 100% Masataka Kinoshita 6 6 100% Masahide Ishikawa*1 3 3 100% Toshihiko Yamashita*2 3 3 100% Kazuo Fukumoto*3 6 6 100% Akihiro Kiyooka*4 - - - Takuji Akiyama 6 6 100% - (*1) This member has retired from the position of Director as of June 23, 2023. Thus, the status of attendance includes attendance at Appointment and Remuneration Committee meetings held during the period prior to the retirement.

- (*2) This member was appointed to the position of Appointment and Remuneration Committee Member as of June 23, 2023. Thus, the status of attendance includes attendance at Appointment and Remuneration Committee meetings held during the period prior to the appointment.

- (*3) This member has retired from the position of Director as of June 21, 2024.

- (*4) No data is available as this member assumed the position of Appointment and Remuneration Committee Member as of June 21, 2024.

The Appointment and Remuneration Committee has determined the following items mainly as details to be deliberated in the current fiscal year.

- Items relating to Evaluation of Directors

- Items relating to candidates for Directors and Representative Directors of subsidiaries

- Items relating to the selection of the positions of Representative Directors and Directors

- Items relating to basic compensation, performance-linked compensation and stock price-linked compensation for Directors

- Items relating to the status of training for management and candidates for management

-

- Conflict of Interest Advisory Committee

-

The Conflict of Interest Advisory Committee consists of three independent persons, chaired by independent director (outside) Toshihiko Yamashita, the independent director (outside) Takuji Akiyama, and lawyer from Nozomi Sogo Attorneys at Law, Hitoshi Shimbo. The Committee deliberates on material transactions, etc. where the controlling shareholders’ interest conflicts with minority shareholders’ from the perspective of protecting the interests of minority shareholders and makes recommendations to the Board of Directors, etc.

The Conflict of Interest Advisory Committee meets, in principle, each time when there is a material transaction, etc. where controlling shareholder’s interest conflicts with the minority shareholders’ interest. The Committee did not meet in the current fiscal year.

-

- Compliance Committee

-

The Compliance Committee consists of five members: chaired by director (outside) Michelle Tan, experts from outside the Company Yasunari Takaura, Outside Director Toshihiko Yamashita and Representative Directors Hiroshi Naruse and Masataka Kinoshita. The Committee discusses and, as necessary, makes recommendations to the Board of Directors about the following compliance-related matters.

- Items relating to formulation, revision or abolishment of the ACOM Group Code of Ethics and Code of Conduct;

- Important items related to establishment and operation of compliance systems;

- Items relating to formulation of basic plans;

- Items relating to the correction of major violations related to compliance, actions for improvement and recurrence prevention measures; and

- Important items related to other compliance issues.

The Compliance Committee meets four times a year, in principle, and more as deemed necessary.

-

- Corporate Risk Committee

-

The Corporate Risk Committee consists of seven members: Deputy Chairman Hiroshi Naruse who chairs the committee, Representative Directors Shigeyoshi Kinoshita and Masataka Kinoshita, and Members of Audit and Supervisory Committee Toshihiko Yamashita (Outside Director), Akihiro Kiyooka and Takuji Akiyama (Outside Director), and an executive officer who concurrently serve as director in charge of Compliance and Risk Management Department Masatoshi Nabeoka.

The Corporate Risk Committee discusses important items related to risk management and makes proposals and reports to the Board of Directors as deemed necessary. The Committee also monitors the status of risk management and other matters and reports the results to the Board of Directors.

The Corporate Risk Committee meets once every quarter, in principle, and more as deemed necessary.

-

- Information Disclosure Committee

-

The Information Disclosure Committee consists of seven members: a deputy chairman Hiroshi Naruse who chairs the committee, a director Takashi Kiribuchi, a member of Audit and Supervisory Committee Akihiro Kiyooka, and executive officers who concurrently serve as directors in charge of the relevant departments, Tomomi Uchida, Masaru Kuroda, Masatoshi Nabeoka and Kazuki Morishita.

To ensure accurate, timely and appropriate information disclosure, the Committee deliberates on matters such as statutory disclosure materials based on the Companies Act and Financial Instruments and Exchange Act, timely disclosure materials based on the Securities Listing Regulations, and matters related to the development of information disclosure systems.

The Information Disclosure Committee meets twice every quarter, in principle, and more as deemed necessary.

(Note) The Company revised the "Financial Information Disclosure Committee" to the "Information Disclosure Committee" as of July 1, 2022.

Executive Officers’ Meeting and other important meetings

The Executive Officers’ Meeting and other important meetings consist of eleven members: President & CEO Masataka Kinoshita who chairs the committee, Representative Directors Shigeyoshi Kinoshita and Hiroshi Naruse, executive officers who serve concurrently as directors Takashi Kiribuchi, Tomomi Uchida, Michihito Onodera, Masashi Yoshiba, Masaru Kuroda, Yuji Kinoshita, Masatoshi Nabeoka and Kazuki Morishita.

In the presence of Members of Audit and Supervisory Committee, the Executive Officers’ Meeting and other important meetings discuss and make decisions related to the execution of important business operations delegated by the Board of Directors to the President and Director, and deliberates management policies and management plans in advance for resolution at the Board of Directors Meeting in accordance with basic policies determined by the Board of Directors.

The Executive Officers’ Meeting and other important meetings assemble three times a month, in principle, and more as deemed necessary.

Appointment of Outside Directors and Reason Thereof

The Company has three Outside Directors. Their relationships with the Company are as shown in the chart below.

With respect to the standards for selecting candidates for independent outside directors, the Company places emphasis on how the candidates satisfy the standards regarding the independency of independent directors stipulated by the Tokyo Stock Exchange and whether or not the candidates have extensive experience, deep insight, and advanced expertise.

| Name of Outside Director | Relations with the Company |

|---|---|

| Michelle Tan |

|

| Toshihiko Yamashita |

|

| Takuji Akiyama |

|

Compensation to Directors and Audit and Supervisory Committee Members

-

- Matters concerning the policy for the decision on the amounts of compensation to Directors and Audit and Supervisory Committee Members or the calculation method thereof

- The Board of Directors determined a policy concerning the decision on the details of individual compensation payable to Directors (excluding Directors serving as Audit and Supervisory Committee Members). In summary, compensation payable to Directors (excluding Directors serving as Audit and Supervisory Committee Members) is designed to sufficiently function as an incentive to aim for sustainable increase in corporate value by benchmarking the compensation levels of peer companies in related industries and segments with similar business scale. Compensation to Representative Directors and Directors serving as Executive Officers consists of basic compensation, performance-linked compensation and stock price-linked compensation, while compensation to part-time Directors consists of basic compensation only. Basic compensation is fixed compensation to be paid once monthly, performance-linked compensation is variable compensation to be paid once yearly according to business results, and stock price-linked compensation is variable compensation to be paid upon retirement according to stock price.

The Company determines the amount of basic compensation payable to Directors (excluding Directors serving as Audit and Supervisory Committee Members) at the Board of Directors after the Appointment and Remuneration Committee deliberates and proposes the respective amounts to be paid according to the position and other factors, in consideration of the compensation levels at other companies, the business results of the Company, the levels of employees’ salaries and other factors. The Company determines the amount of performance-linked compensation payable to Directors (excluding Directors serving as Audit and Supervisory Committee Members) at the Board of Directors after the Appointment and Remuneration Committee calculates the basic source of distribution using “Profit attributable to owners of parent” as an indicator to make a comprehensive measurement of the results of the management, and deliberates and proposes the respective amounts to be paid according to the positions, individual evaluations and other factors. The amount of stock price-linked compensation is calculated by multiplying the number of phantom stocks which are granted every year by the stock price three years late and the Company determines as to the grant of phantom stocks at the Board of Directors after the Appointment and Remuneration Committee deliberates and proposes such grant in consideration of its business condition, etc.

The target percentage of variable compensation (performance-linked compensation and stock price-linked compensation) out of total compensation is approximately 25% (assuming a standard amount of performance-linked compensation and stock price-linked compensation). The amount of performance-linked compensation is decided by a method whereby the Appointment and Remuneration Committee first determines a range of profit attributable to shareholders of the parent company, which becomes a standard for basic source of distribution, by taking into consideration special factors such as extraordinary income or losses from profit attributable to shareholders of the parent company, and the Board of Directors determines a specific amount of performance-linked compensation by multiplying the basic source of distribution by a ratio corresponding to the ratio of distribution for each title and individual evaluation of Directors. The amount of stock price-linked compensation is decided by a method whereby the Appointment and Remuneration Committee first determines a number of phantom stocks calculated based on a standard amount set every year for each Representative Director and Director serving as an Executive Officer, and the Company determines as to the grant thereof at the Board of Directors. The phantom stocks are converted into points by multiplying the number of phantom stocks by the stock price three years later, and the points accumulated during the term of office are converted into a specific amount to be paid upon retirement.

While target figures for the indicator for performance-linked compensation have not been determined for the current fiscal year, the actual figure of the basic source of distribution amounted to 35 million yen, with the standard range of profit attributable to shareholders of the parent company from 50,000 million yen to less than 60,000 million yen.

Other details of the compensation payable to Directors are deliberated and proposed by the Appointment and Remuneration Committee and thereupon determined by the Board of Directors. The amount of compensation payable to Audit and Supervisory Committee Members is determined through consultation among Audit and Supervisory Committee Members in consideration of their duties and responsibilities. The stock price-linked compensation system (phantom stocks) decided at the Board of Directors meeting held on January 31, 2023, was introduced and started in June 2023 for the purpose of incentivizing management to demonstrate sound entrepreneurial spirit as well as further promoting value sharing with shareholders, toward the Company's sustainable growth and enhancement of medium- to long-term corporate value.

At the 40th Ordinary General Meeting of Shareholders held on June 22, 2017, it was resolved that compensation payable to Directors (excluding Directors serving as Audit and Supervisory Committee Members) per year shall be no more than 400 million yen (excluding the portion of employee’s salary payable to Directors who concurrently serve as employees). The number of Directors (excluding Directors serving as Audit and Supervisory Committee Members) as of the conclusion of the above Ordinary General Meeting of Shareholders was six. In addition, at the same Ordinary General Meeting of Shareholders, it was resolved that compensation payable to Directors serving as Audit and Supervisory Committee Members per year shall be no more than 100 million yen. The number of Directors serving as Audit and Supervisory Committee Members as of the conclusion of the above Ordinary General Meeting of Shareholders was four. As of March 31, 2023, the number of Directors (excluding Directors serving as Audit and Supervisory Committee Members) was six and the number of Directors serving as Audit and Supervisory Committee Members was three.

The details of the individual compensation payable to each Director (excluding Directors serving as Audit and Supervisory Committee Members) for the fiscal year under review were determined by the Board of Directors within the compensation limit approved by the general meeting of shareholders respecting the proposal from the Appointment and Remuneration Committee submitted upon deliberation based on the Director’s position, evaluation, and other factors. Therefore, the Company believes that the details are in line with the Policy.

For the composition of the Appointment and Remuneration Committee and the Audit and Supervisory Committee and details of the committees’ activities, please see (a) Appointment and Remuneration Committee in 4. Corporate Governance, (1) Overview of Corporate Governance, 2) Corporate Governance Structure, (i) An overview of corporate governance structure and reasons for employing said structure, (C) Committees, and (B) Audit and Supervisory Committee.

-

- Total amount of compensations by categories for the Filing Company, total amount of compensations by type, and the number of paid officers

-

Category Total amount

(Millions of yen)Total amount of compensations by type (Millions of yen) Number of Persons Fixed compensation Performance-linked compensation Stock price-linked compensation Directors

(excluding

Audi and

Supervisory

Committee

Members

and

Outside

Directors)197 154 31 11 7 Audit

and

Supervisory

Committee

Members

(excluding

Outside

Directors)20 20 - - 1 Outside

Directors

and

Outside

Audit and

Supervisory

Committee

Members32 32 - - 3 Total 250 207 31 11 11 (Notes)

1. There are no employee-directors.

2. "Number of persons" represents the cumulative number of officers who received compensation during the current fiscal year.

3. stock price-linked compensation is the amount reported as expenses in the current fiscal year.

-

- Total amount of consolidated compensations by Filing Company's officers.

- This is omitted as none of officers of the Filing Company received aggregated consolidated compensations of 100 million yen and above.

Status of securities held by the Company

-

- Criteria and basic stance of classification of investment securities

- For classification between investment securities held for pure investment purposes and investment securities held for other than pure investment purposes, the Company does not hold any investment securities held for other than pure investment purposes and does not have a plan to hold them in the future.

-

- Investment securities held for other than pure investment purposes

- Not applicable

-

- Investment securities held for pure investment purposes

-

Classifi

cationFiscal Year Ended March 2024 Fiscal Year Ended March 2023 Number of names

(Name)Value in balance sheet

(Millions of yen)Number of names

(Name)Value in balance sheet

(Millions of yen)Non-listed

Securities18 950 18 950 Securities

other than

the above1 0 2 0 Classifi

cationFiscal Year Ended March 2024 Total dividend received

(Millions of yen)Total gain or loss on sale

(Millions of yen)Total valuation gain or loss

(Millions of yen)Non-listed

securities29 - (Note) Securities

other than

the above0 0 - (Note) “Total valuation gain or loss” is not shown for non-listed securities, since they have no market values.

-

- Investment securities, of which holding purpose has been changed from pure investment to other than pure investment

- Not applicable

-

- Investment securities, of which holding purpose has been changed from other than pure investment to pure investment

- Not applicable

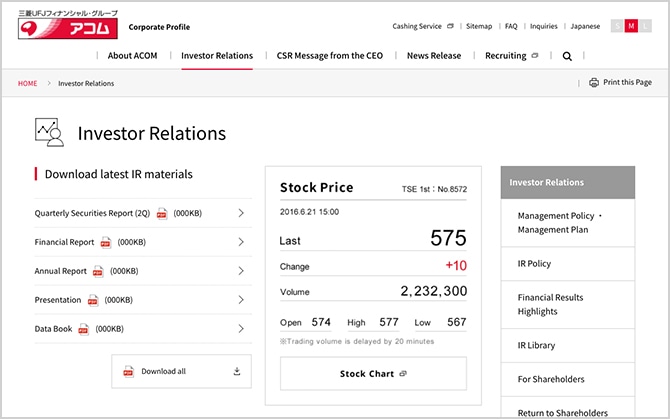

Promoting Prompt and Accurate Fair Disclosure

ACOM endeavors to maintain and improve transparency of management for the benefit of stakeholders through accurate and prompt disclosure of various management information. Concurrently, ACOM concentrates on diverse investor relations activities both in domestic and overseas. These consist of, but not limited to: earnings release conferences for investors and institutional analysts; individual interviews; conference calls, and overseas IR roadshow.